The Accounting Equation: What It Is & The Effects of Common Transactions

Préstamos Rápidos prestamos rapidos Desprovisto Folio

1 November, 2023Bingo casino med direkt utbetalning Com Rörlig

5 November, 2023The Accounting Equation: What It Is & The Effects of Common Transactions

It is an important financial statement that is a key component of the balance sheet. While the financial landscape continues to evolve and undergo dynamic changes, a key foundational element that continues to guide accounting processes across industries is the accounting equation. Acting as the cornerstone for financial statements, it holds the key in enabling us to understand the financial health of an organization. While double-entry accounting is more complicated than single-entry accounting, the end result is more accurate financial statements and books always in balance, both worth a few extra minutes of work.

- The equity, or owner’s equity, is the claim of the owners of the business (those “inside” the business).

- Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more.

- Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners.

- Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides.

- An asset is a resource that can provide current or future economic benefit to the organization who owns or controls the asset.

- In order to carry out its operations, such as production and sales, the company uses its assets.

Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

How to calculate assets in accounting?

The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity. For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). For example, an increase in an asset account can be matched by an equal increase to a related liability or shareholder’s equity account such that the accounting equation stays in balance. Alternatively, an increase in an asset account can be matched by an equal decrease in another asset account. It is important to keep the accounting equation in mind when performing journal entries.

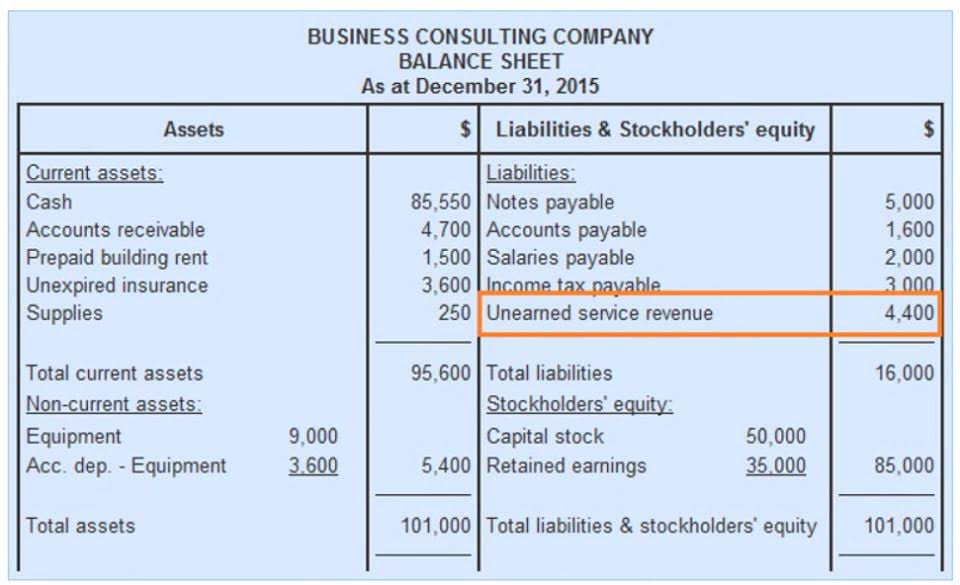

When a company first starts the analysis process, it will make a list of all the accounts used in day-to-day transactions. For example, a company may have accounts such as cash, accounts receivable, supplies, accounts payable, unearned revenues, common stock, dividends, revenues, and expenses. Each company will make a list that works for its business type, and the transactions it expects to engage in. The accounts may receive numbers using the system presented in Table 3.2. The accounting equation is the backbone of the accounting and reporting system. It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position).

Equity and the Expanded Accounting Equation

Journal entries often use the language of debits (DR) and credits (CR). A debit refers to an increase in an asset or a decrease in a liability or shareholders’ equity. A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity. While trying to do this correlation, we can note that incomes or gains will increase owner’s equity and expenses, or losses will reduce it.

The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. As a result of this transaction, the asset (accounts receivable) and the owner’s equity (revenues) both increased by $5,000. It’s the compass that guides all accountants and bookkeepers, even if transactions get complex. For small businesses, knowing how the accounting equation works can help you better understand financial statements, along with how bookkeepers do their jobs. Double-entry bookkeeping is a fundamental accounting concept that requires every financial transaction to affect at least two different accounts.

What Are the Three Elements of the Accounting Equation?

Remember, when a customer purchases something “on account” it means the customer has asked to be billed and will pay at a later date. Equipment examples include desks, chairs, and computers; anything that has a long-term value to the company that is used in the office. Equipment is considered a long-term asset, meaning you can use it for more than one accounting period (a year for example). Equipment will lose value over time, in a process called depreciation. If the total liabilities calculated equals the difference between assets and equity then an organization has correctly gauged the value of all three key components.

The accounting equation connotes two equations that are basic and core to accrual accounting and double-entry accounting system. We will examine the operations of “ABC Enterprise” to show how to analyze the accounting equation is usually expressed as transactions in terms of the accounting equation. The transaction that takes place as a result of an event can bring about any of the following changes to the components of the accounting equation.

How to show the effect of transactions on an accounting equation?

Based on the data in the previous section, here’s the journal entry to record the payment of the accrued December rent in January. Because of the two-fold effect of business transactions, the equation always stays in balance. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Metro issued a check to Office Lux for $300 previously purchased supplies on account. At the heart of HighRadius’s R2R solution is an AI-powered platform designed to cater to all accounting roles.

Expenses are defined as the amount of money spent on the acquisition of goods or services that are used to produce revenue. They are deductions from an owner’s equity that are caused by the operation of a business. The term “residual equity” is frequently used to refer to the owner’s equity. This is due to the fact that ownership claims have to be paid after creditor claims. The rights or claims that can be made against these resources are referred to as liabilities and owner’s equity.